Wise Decisions with Retirement in Mind

Some retirees succeed at realizing the life they want, others don’t. Fate aside, it isn’t merely a matter of stock market performance or investment selection that makes the difference. There are certain dos and don’ts – some less apparent than others – that tend to encourage retirement happiness and comfort.

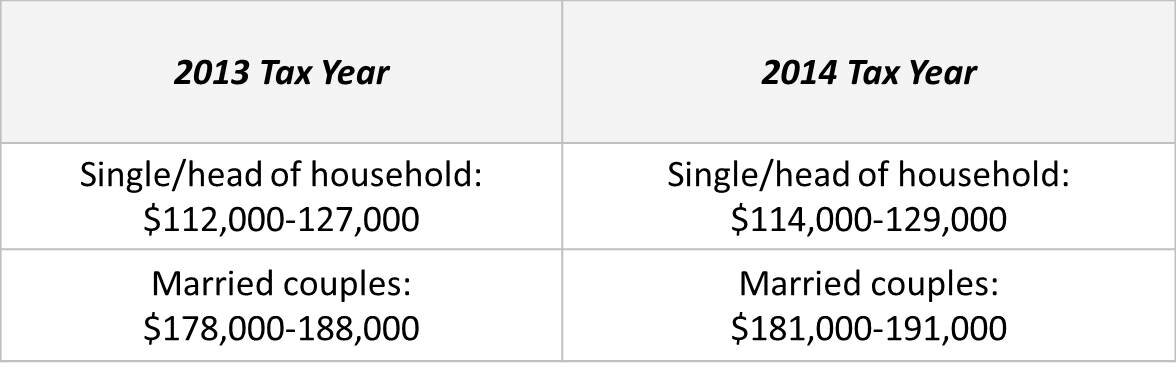

2014 IRA Deadlines Are Approaching

Financially, many of us associate April with taxes – but we should also associate April with important IRA deadlines.

Making Your Money Work Harder in Retirement

When planning for retirement, people naturally think about the big things – arranging sufficient income, amassing enough savings, investing so that you don’t outlive your money, managing forms of risk. All of this is essential. Still, there are also...

Why 2014 May Be a Very Good Year

HAPPY NEW YEAR! More improvement may be in store for the economy & the stock market...

RMD Precautions & Options

An important reminder about mandatory withdrawals from IRAs & other retirement plans...

Should You Retire Now or Later?

Increasingly, baby boomers are urged to work until full retirement age or beyond. If your health and workplace allow this, it may be a good idea for a few notable reasons...

Getting it All Together

Where is everything? Time to organize and centralize your documents - here is a list and step-by-step instructions for you to consider.

Social Security in 2014

Next year’s small COLA isn't the only adjustment related to the program.

End-of-the-Year Money Moves

Even if your 2013 has been relatively uneventful, the end of the year is still a good time to get cracking and see where you can plan to save some taxes and/or build a little more wealth.

What's Next in the Debt Ceiling Debate

At first thought, it seems inconceivable that Congress would want to go through another protracted fight like the one that shut things down for 16 days in October. That could occur, however, if a new budget panel doesn’t meet its deadline.

Annual Financial To-Do List

What financial, business or life priorities do you need to address for 2014? Now is a good time to think about the investing, saving or budgeting methods you could employ toward specific objectives. Some year-end financial moves may prove crucial to the pursuit of those goals as well.

Medicare Open Enrollment

The open enrollment period for 2014 runs from October 15-December 7, 2013. This is not only a period where you may enroll for the program, but also switch providers for your comprehensive health and drug coverage. Here are some key dates to remember...

Women & Money Paralysis

There is an old belief that women are more cautious about money than men, and whether you believe that or not, both women and men may fall prey to a kind of money paralysis as they age – in which financial indecision is regarded as a form of “safety.”

What Women Should Not Retire Without

When our parents retired, living to 75 amounted to a nice long life and Social Security was often supplemented by a pension. How different things are today! The good news is that life expectancy for women – as measured by the Centers for Disease Control – is now 81.1 years. The Social Security Administration estimates that the average 65-year-old woman today will live to age 86. Given these projections, it appears that a retirement of 20 years or longer might be in your future.

Legacy Planning for Women

Women often become guardians of family wealth. Many women outlive their spouses, and have the opportunity to have the “final say” (from an estate planning standpoint) about the wealth they have built or inherited. Legacy planning is essential for single women and couples, too, as one or two successful careers may leave a woman or a couple with a significant estate.

Why Women are Prepared for Financial Success

Statistics don’t mean everything. Read enough about women and money online, and you will run across numbers indicating that women finish a distant second to men in saving and investing. Depressing?

Women Need to Take Charge of Their Money

Many women are in charge of their financial lives, and proudly so. Some have become their own financial captains as a result of life events; others have always steered their own ships. Even so, there are too many women who are left out of financial decision making – some by their own choice.

The 1995-96 Government Shutdown and Its Impact

In late 1995, the economy had been expanding – similar to today. Stocks were on a tear: a powerful bull market had begun in 1992, and it was far from over. Between 1992 and 2000, the Dow rose about 7,800 points. In fact, it gained almost 3,000 points (about 75%) between January 1995 and March 1997.

What if America Shatters its Debt Ceiling?

During October, America may risk running out of cash. Treasury Secretary Jacob Lew recently urged Congress to lift the federal debt limit before October 17. Secretary Lew claims that if nothing is done by that date, the Treasury will have only about $30 billion in available cash to pay down as much as $60 billion in daily net expenditures. The nonpartisan Congressional Budget Office has a slightly different opinion: it believes that the government will run out of free cash sometime between October 22 and November 1 if a stalemate persists on Capitol Hill.

Pension Questions After Detroit Bankruptcy

In the wake of Detroit’s fiscal problems, current and future pension recipients across the country are wondering about the stability and amount of their promised incomes.