![2/10 Weekly Update [VIDEO]](https://images.squarespace-cdn.com/content/v1/648c6df3d50397623855b25e/1695328480719-BT7U1ZMVX0GDQRLS66IP/WEVU+overlay+-+play.png)

2/10 Weekly Update [VIDEO]

Investors bought back into stocks Thursday and Friday, offsetting last Monday’s major plunge. That resulted in the following weekly performances: DJIA, +0.61% to 15,794.08; NASDAQ, +0.54% to 4,125.86; S&P 500, +0.81% to 1,797.02.

Why Does Family Wealth Fade Away?

In the late 19th century, industrial tycoon Cornelius Vanderbilt amassed the equivalent of $100 billion in today’s dollars – but when 120 of his descendants met at a family gathering in 1973, there were no millionaires among them.

2/3 Weekly Video Update

As expected, the Federal Reserve announced last week that it would reduce its monthly bond purchases by another $10 billion starting in February. Wall Street struggled for most of the week, with the 5-day performances as follows: DJIA, -1.13% to 15,698.85; NASDAQ, -0.59% to 4,103.88; S&P 500, -0.43% to 1,782.59.

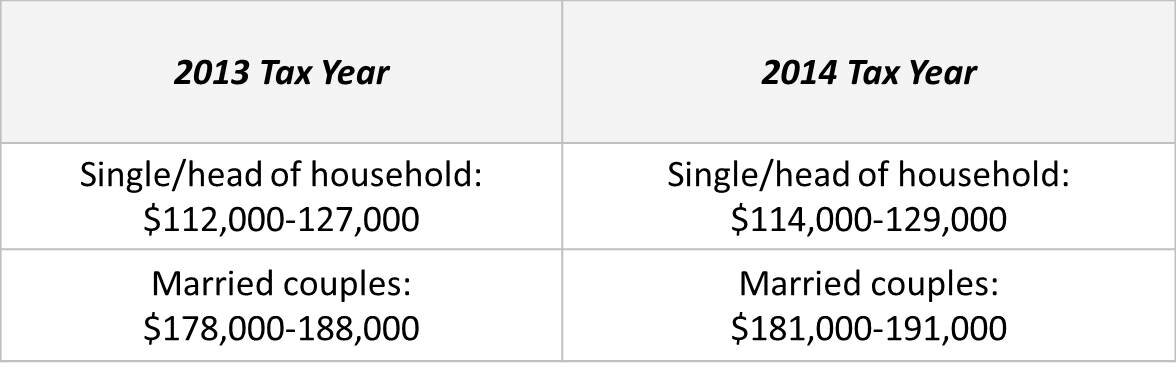

2014 IRA Deadlines Are Approaching

Financially, many of us associate April with taxes – but we should also associate April with important IRA deadlines.

1/27 Weekly Video Update

Weak manufacturing data from China and an exit from emerging market currencies triggered a 2-day global sell-off at the end of last week. The Argentine peso dropped 15% in 5 days, and the Russian ruble, South African rand and Brazil real also slumped. As a result, the DJIA had its poorest week in more than 2 years (-3.52%). The Nasdaq lost 1.65% for the week while the S&P 500 fell 2.63%. At the close Friday, here was where the big three stood: S&P, 1,790.29; DJIA, 15,879.11; NASDAQ, 4,128.17.

Making Your Money Work Harder in Retirement

When planning for retirement, people naturally think about the big things – arranging sufficient income, amassing enough savings, investing so that you don’t outlive your money, managing forms of risk. All of this is essential. Still, there are also...

1/21 Weekly Update (WATCH - ALL NEW!)

Thanks to a 0.55% 5-day advance, the tech-heavy Nasdaq became the first of the big three to go positive so far for 2014. The Dow gained 0.13% last week; the S&P 500 retreated 0.20%. Friday, the indices settled as follows: DJIA, 16,458.56; NASDAQ, 4,197.58; S&P, 1,838.70.

1/13/14 Weekly Update

The first full trading week of 2014 brought 5-day gains for the S&P 500 (0.60%) and Nasdaq (1.03%) but a 0.20% pullback for the Dow. Friday, the big three closed as follows: DJIA, 16,437.05; NASDAQ, 4,174.67; S&P, 1,842.37.

1/6 Weekly Update

Speaking in Philadelphia Friday, Federal Reserve chairman Ben Bernanke asserted that the economy has made “considerable progress”, and that there are “grounds for cautious optimism abroad.” His remarks didn’t give stocks much of a lift to end the week. From December 30-January 3, the S&P 500 lost 0.54%, the Dow 0.05% and the Nasdaq 0.59%. The closing prices Friday: Dow, 16,469.99; Nasdaq, 4,131.91; S&P, 1,831.37.

Looking Back at 2013

Was 2013 a terrific year for stocks? Absolutely. The good news wasn’t limited to Wall Street, however: the employment rate fell, the economy revved up, home prices rose and inflation pressure was minimal.

Why 2014 May Be a Very Good Year

HAPPY NEW YEAR! More improvement may be in store for the economy & the stock market...

12/30/13 Weekly Update

A short trading week saw the S&P 500 advancing another 1.27% to 1,841.40, the Dow climbing 1.59% to 16,478.41 and the NASDAQ gaining 1.26% to 4,156.59

12/23 Weekly Update

S&P 500 HAS BEST WEEK SINCE MID-OCTOBER - the broad benchmark closed at 1,818.55 Friday, gaining 2.44% in five days. Weekly gains for the DJIA (2.96%) and NASDAQ (2.59%) were even greater. The NASDAQ wrapped up the week at 4,104.74, the DJIA at 16,221.72.

12/16/13 Weekly Update

Signals of an improving economy also brought worries about a December taper by the Federal Reserve. As a consequence, the S&P 500 (-1.65% to 1,775.32), NASDAQ (-1.51% to 4,000.98) and Dow (-1.65% to 15,755.36) all staged 5-day retreats

12/9 Weekly Update

After strong employment and personal spending data arrived Friday, the S&P 500 snapped a 5-day losing streak. The Dow gained 198.69 Friday. The week was not as terrific. While the NASDAQ rose 0.06% in five days to settle at 4,062.52 Friday, the S&P lost 0.04% to close the week at 1,805.09 and the Dow lost 0.41% to wrap up the week at 16,020.20.

RMD Precautions & Options

An important reminder about mandatory withdrawals from IRAs & other retirement plans...

12/2 Weekly Update

The NASDAQ was the frontrunner among the big three U.S. indices last week, rising 1.71% to 4,059.89. Both the S&P 500 (+0.06% to 1,805.81) and Dow (+0.13% to 16,086.41) realized tiny gains during the abbreviated trading week. Turning to the NYMEX, oil and gold both had poor Novembers: on the month, gold slid 5.46% to $1,250.60 an ounce and light crude dropped 3.60% to $92.72 a barrel.

Should You Retire Now or Later?

Increasingly, baby boomers are urged to work until full retirement age or beyond. If your health and workplace allow this, it may be a good idea for a few notable reasons...

Getting it All Together

Where is everything? Time to organize and centralize your documents - here is a list and step-by-step instructions for you to consider.

11/25/13 Weekly Update

While the October Federal Reserve policy meeting minutes revealed the possibility of tapering QE3 in “the coming months,” stocks still pulled higher on the week. The Dow (+0.65% to 16,064.77), NASDAQ (+0.14% to 3,991.65) and S&P 500 (+0.37% to 1,804.76) all shrugged off midweek dips.